how much will my credit score increase with a car loan

Your score will increase as it satisfies all of the factors the contribute to a credit score adding to your. Taking out an auto loan affects all four determining factors of your credit score.

Missing Payments Accruing More Debt Than Income And Applying For Or Canceling A Lot Of Credit Cards Will Negative Car Loans Credit Score Improve Credit Score

If you make all of your payments on time your credit score increases.

. The credit score drop may only be temporary but you can save money. Generally the more experience you have and the older your accounts the better your credit score will be. Length of credit history.

A credit score can go through a lot of changes over a couple of years. As you make on-time loan payments an auto loan will improve your credit score. The impacts of a car loan start with the first inquiry on your credit score.

Refinancing a car has a. It augments your payment history raises your total amount owed adds another figure to your average credit age and contributes an additional credit type to your portfolio. Over the course of the loan this can really add up.

A score drop could happen if the loan you paid off was the only loan on your. Your overall debt load is the second most important factor in your credit score contributing to 30 percent of the total. After all for many of us a loan to buy a car or truck will be one of our largest loans.

When combined with overall interest rate declines this could rack you up some appreciable savings. In fact the average. One of the vital signs of your financial stability is your credit score.

Paying off a loan might not immediately improve your credit score. Deciding on whether to pay the loan off early or not depends on your finances and priorities. This measures the amount of experience you have using credit.

The best way to make sure you get the most impact in this area is to pay all your monthly bills. Fortunately any temporary hits to your credit score will vanish as time passes. For example lenders want to see that.

A new auto loan can also help improve your credit mix which comprises 10 of your credit score. Actual pay-off rates will vary based on. How Many Points Will My Credit Score Increase When I Pay Off Collections.

Getting a new car loan has two predictable effects on your credit. The higher your credit score the easier it is to get additional loans or lines of credit. Thats because you are taking on extra debt and one factor in a FICO credit score is how much debt you have.

Heres what you need to know about a loans impact on your credit history and credit score while youre paying it off and after its paid in full. In fact your score could drop or stay the same. The biggest piece of the pie is payment history making up 35 percent of your credit score.

Because car loans and other borrowing stays on your credit report for so long its important to pay on time every. The initial act of taking out a car loan slightly decreases your credit score. B an average monthly payment of 3 of their credit card balances.

A higher credit score. If you increase your credit score significantly in the 12 months or so after taking out a car loan you may qualify for loan offers with better interest rates. How Does Paying Off a Loan Affect Your Credit.

The most reliable way to grow your credit is by. Once you start making payments your score will bump right back up. However if you quickly pay down the loan by paying it off or by paying more than the monthly minimum payments you.

May Payments on time All Remove Incorrect or negative info from your report or hire someone to Keep Old Credit Accounts Will my credit score drop if I buy a new car. When you sign for the loan youll typically see another small score dip. It adds a hard inquiry to your credit report which might temporarily shave a few points off your score.

Your credit score is higher. The car loan remains on your credit for the life of the loan plus another 10 years. If your credit isnt where it should be improving your credit score before you go car shopping could save you thousands of dollars in interest costs.

Posted by Frank Gogol Updated on April 26 2022. If you take out a massive car loan or if you already have significant other debts your car loan could actually harm your credit. Fair Isaac Corporation FICO uses five factors to calculate your credit score and your credit age makes up 15 of the score.

This means lenders are likely to use your FICO score to gauge your ability to take on a car loan. For each borrower we used. For the quickest results.

For one if you pay off the balances of your credit cards youll lower your credit utilization ratio a determiner in your credit score. Because keeping your auto loan can add or detract from your credit score its hard to say with certainty that. We assumed the borrower received Tally discount credit every month.

Your credit score may actually decrease after you pay off the loan early. All these factors generate a three-digit number from 300 to 850 or your credit score. This is for the FICO credit scoring model which is the most commonly used.

10 Keeps track of how many times you apply for new credit. It immediately shows lenders how responsibly you utilize credit. A their average APR weighted by their initial credit card balances and APRs.

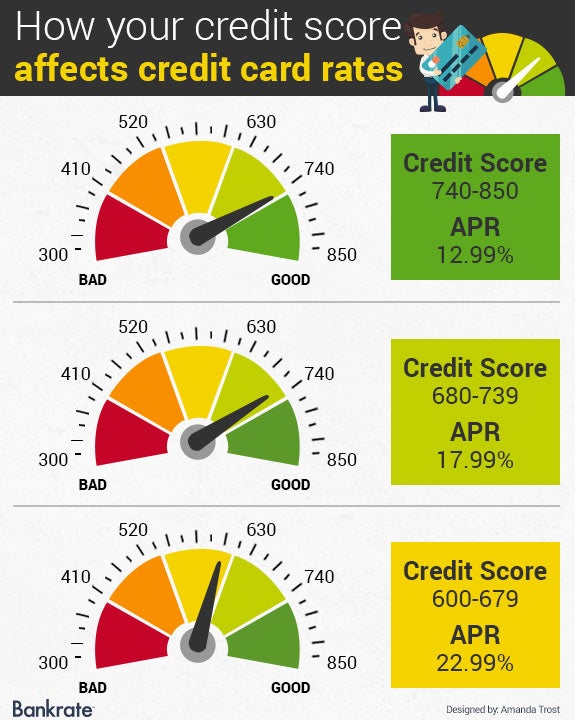

The highest on record and an increase of almost 1000 from a year ago. Sometimes it doesnt increase at all. Lower credit scores generally translate into higher interest rates on your auto loan.

There are a few credit scoring models out there but FICO is usually the one thats used by auto lenders. And c average monthly credit card transactions of 08 of their credit card balances. This typically causes a small reduction in your credit score.

But the positive effects will last for the length of the loan as long as you continue making on-time payments. So how much does your credit score increase after paying off a car. Most of us 84 rely on financing when purchasing a vehicle according to data from Experian Automotive fourth quarter 2014 and the average loan amount for a new vehicle is 28381.

The good news is financing a car will build credit. When you take out an auto loan especially a bad credit car loan you gain the opportunity to make a positive impact on your credit by making all your monthly payments on time and in full. Even if it is only a couple of percentage points lower a minor interest rate adjustment will still save you a lot of money over time.

15 of your score comes from the length of your credit history which refers to the age of your oldest reported account the average ages of all of your accounts and other time-related factors. If you have a five-year car loan for example the loan will affect your credit for a total of 15 years. There are three factors to your credit age.

If you bought a car with a low or nonexistent score and it has since improved you can garner a lower interest rate by refinancing. How an auto loan can help your credit score. Additional Ways to Build a Positive Credit History.

The short answer is. Yes simply by getting your car loan you add diversity Credit Mix to your credit report contributes to 10 of your score.

What Is A Good Credit Score To Buy A Car

What Is Considered Bad Credit Legacy Auto Credit

What Credit Score Is Needed To Buy A Car Infographicbee Com Credit Score Credit Repair Business Money Management Advice

How To Get A Car Loan With No Credit History Lendingtree

How To Increase A Credit Score To 800 5 Proven Tips Credit Repair Business Credit Repair Improve Credit Score

Credit Score Needed To Buy A Car In 2021 Lexington Law

7 Strategies That Will Raise Your Credit Score In 2022 Improve Your Credit Score Credit Score Good Credit

What Credit Score Is Needed To Buy A Car Lendingtree

Does Financing A Car Build Credit

:max_bytes(150000):strip_icc()/what-is-a-good-interest-rate-on-a-car-5176189_v3-fa00f898e38b4fb4b5f14109ea7a478c.png)

What Is A Good Interest Rate On A Car Loan

What S The Minimum Credit Score For A Car Loan Credit Karma

Credit Score Your Number Determines Your Cost To Borrow

What Credit Score Do You Need To Get A Car Loan

How Fast Will A Car Loan Raise My Credit Score Plus The Secret To Rate Shopping

Auto Loan Rates By Credit Score Experian

Decoding The Factors That Determine Your Credit Score Daily Infographic Credit Score Infographic Good Credit Credit Repair

Today We Take A Look At The Difference Good Credit Vs Bad Credit Can Make Bad Credit Can Still Get You Appro Credit Repair Good Credit Credit Repair Services