us germany tax treaty withholding rates

In the absence of a tax treaty this tax is imposed at a rate of 25. A new tax treaty between Israel and Germany is effective as of 1 January 2017 in force.

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Tax return and Form 8833 if you claim the following treaty benefits.

. If the treaty does not cover a particular kind of income or if there is no treaty between your country and the United States. Argentina and the United States of America Limited. A change to the source of an item of income or a deduction based on a treaty.

For further information on tax treaties refer also to the Treasury Departments Tax Treaty Documents page. Tax resident is entitled to the listed rate of tax from a foreign treaty country although generally the treaty rates of tax are the same. However the taxpayer could potentially avoid this via double tax treaty if there is one in place.

Last reviewed - 01 August 2022. Reduced withholding rates of 15 and 20 may apply because of the Encouragement of Capital Investments Law. 25 0 15 or upon application as reduced by EU directivedouble tax treatydomestic law.

A reduction or modification in the taxation of gain or loss from the disposition of a US. IP registrable in Germany includes for example patents trademarks and designs. Tax Rates on Income Other Than Personal Service Income Under Chapter 3 Internal Revenue Code and Income Tax Treaties Rev.

In other situations withholding agents may apply reduced rates or be exempted from the requirement to withhold tax at source either under domestic law exceptions or when there is a tax treaty between the foreign persons country of residence and the United States that provides for such reduction or exemption. Skip to content Skip to footer. China Tax Treaties A quick guide to withholding tax rates of.

151 rows Withholding tax WHT rates Dividend interest and royalty WHT rates for WWTS territories. Germany - Tax Treaty Documents. They purchase over 28 of Israels exports and sell over 11 of Israels imports.

62 rows Corporate - Withholding taxes. Real property interest based on a treaty. Like many countries Germany imposes a withholding tax on dividends paid to foreign investors.

All persons withholding agents making US-source fixed determinable annual or periodical FDAP payments to foreign persons generally must report. Interest for example or the release or transfer of the debt This note. Double Tax Treaties and Withholding Tax Rates.

Israels main trading partner is the United States. Most importantly for German investors in the United States the Protocol would eliminate the withholding. Additionally gains from the sale of IP registered in Germany would also be subject to tax at a flat rate of 15825.

This table should not be relied on to determine whether a US. 10 2015 the Senate Foreign Relations Committee approved this treaty. The treaty is not in effect.

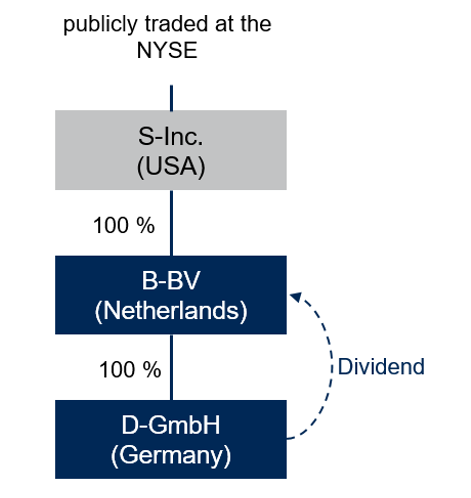

Due to the Dutch dividend withholding tax exemption and the tax treaty. This simplified procedure is only applicable to licensors who 1 are tax resident in a treaty state ie a state with which Germany has concluded an income tax treaty eg the US 2. For payments post 2013 taxpayers could remit withholding payments and file taxes with the German Federal Tax Office.

United States Last reviewed 01 August 2022 Resident. A German tax obligation arises for royalty payments and capital gains derived from IP registered with a domestic register. The double taxation treaty or the income tax agreement between Germany and the United States of America entered into force in 1990 and it serves as an instrument for the abolition of double taxation on income earned by US and German residents who do business in both countries.

A European registration may also be considered to. If you have problems opening the pdf document or viewing pages download the latest version of Adobe Acrobat Reader. Implement the same withholding rates as footnote 3.

98 rows The tax authorities can order a WHT of 15825 including solidarity. The complete texts of the following tax treaty documents are available in Adobe PDF format. Most income tax treaties contain what is known as a saving clause which prevents a citizen or resident of the United States from using the provisions of a tax treaty in order to avoid taxation of US.

Todays issues Insights Industries Services About us Careers. Consequently if a withholding overseas tax rate is higher than a treaty rate then the steps must be taken by US investors to decrease the withholding tax at the source to 15 treaty rate. The purpose of the Germany-USA double taxation treaty.

A credit for a specific foreign tax for which. Germany 3 15 27 28 5 24. You must file a US.

Article 11 1 of the United States- Germany Income Tax Treaty generally grants to the State of residence the exclusive right to tax interest beneficially owned by its residents and arising in the other Contracting State. US laws and is classified as a corporation for US tax purposes interest paid by a UK. The Germany-US double taxation.

This table lists the income tax and withholding rates on income other than for personal service income including rates for interest dividends royalties pensions and annuities and social security payments. Under US domestic tax laws a foreign person generally is subject to 30 US tax on the gross amount of certain US-source income. Article 11 2 provides a definition of the term interest.

This is an important point because UK withholding tax. The tax rate is 15825 15 corporate income tax plus 55 solidarity surcharge thereon. Obligors General Treaty.

On June 1 2006 the United States and Germany signed a protocol the Protocol to the income tax treaty between the two countries as amended by a prior protocol the Existing Treaty. 1 A recent ruling 2 of Germanys highest tax court the Bundesfinanzhof addresses the longstanding question of whether certain dividends paid to an S corporation may qualify for the favorable 5. The USA has tax treaties with more than 66 countries that provide the taxation of foreign dividends at reduced treaty rates.

On July 7 2015 the US. Interest ccc Dividends Pensions and Annuities Income Code Number 1 6 7 15 Name Code Paid by US. And Vietnam signed a new tax treaty and protocol that generally would implement the same withholding rates as described in footnote 3 not yet in effect.

How Big Is France In Comparison To Belgium

Us Expat Taxes For Americans Living In Germany Bright Tax

What Countries Have The Highest Electric Car Stock Answers

Germany Adopts Substantial Transfer Pricing And Anti Treaty Shopping Rule Changes Mne Tax

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Status Of Russia S Initiative On Amending Its International Tax Treaties To Increase Withholding Tax Rate On Dividends And Interest To 15 Percent Deloitto China

What Are The Countries That Surround France Answers

Us Expat Taxes For Americans Living In Germany Bright Tax

Pros And Cons Of Public Provident Fund Ppf Account For Tax Saving On India

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Llc Limited Liability Company And German Taxation

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

How To Avoid Double Taxation In Germany Settle In Berlin

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

What Country Has The Most Public Libraries In The World Answers

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

Blinken Unaware Of Germany S Tax Penalties On Us Military Personnel Says He Will Get Involved Stars And Stripes

6 German A Graded Companies With 20 Upside And 1 Growth Stock Seeking Alpha